Rule Britannia! Britannia

making waves, again…

The Rule Britannia! song has made headlines this month at the Last Night of the Proms, where the BBC reversed its decision to axe it on contentious grounds after decades of inclusion. Whilst this episode did cause quite a stir amongst the British people, it speaks volumes for Britain’s growing reputation on the world stage for dither and delay in handling its issues and current affairs, with Brexit and Coronavirus at the top of the list this year as its headline mismanagements.

In September the British Tory government introduced the UK Internal Market Bill in September as part of its latest Brexit trade deal negotiating tactics with the EU. Unsurprisingly this made waves across the continent and caused significant controversy as it was seen as an attempt to re-write parts of the Brexit Withdrawal Agreement signed by Boris Johnson only last year.

Whether this is another monumental miscalculation by the Johnson administration, or a brilliant tactical ploy on behalf of the 17.4 million people that voted to leave the EU in 2016 remains to be seen, but it will inevitably unfold over the coming months as the Brexit transition period comes to an end and the deadline for a trade deal with the EU expires on 31 December 2020.

At the start of 2020 it was almost completely unfathomable that anything else could overshadow the four-year Brexit saga which had dominated British news and debate, and was finally reaching a crescendo. Then came coronavirus, adding another layer of uncertainty to UK politics and disruptive complexity to the global ecosystem.

Without doubt the 2020 pandemic will remain an historical reference point for centuries to come, but seven months in and as we enter flu season in the northern hemisphere the virus is still spreading uncontrollably in some countries, with the UK quickly becoming one of the countries hit worst in Europe by a second wave of infections.

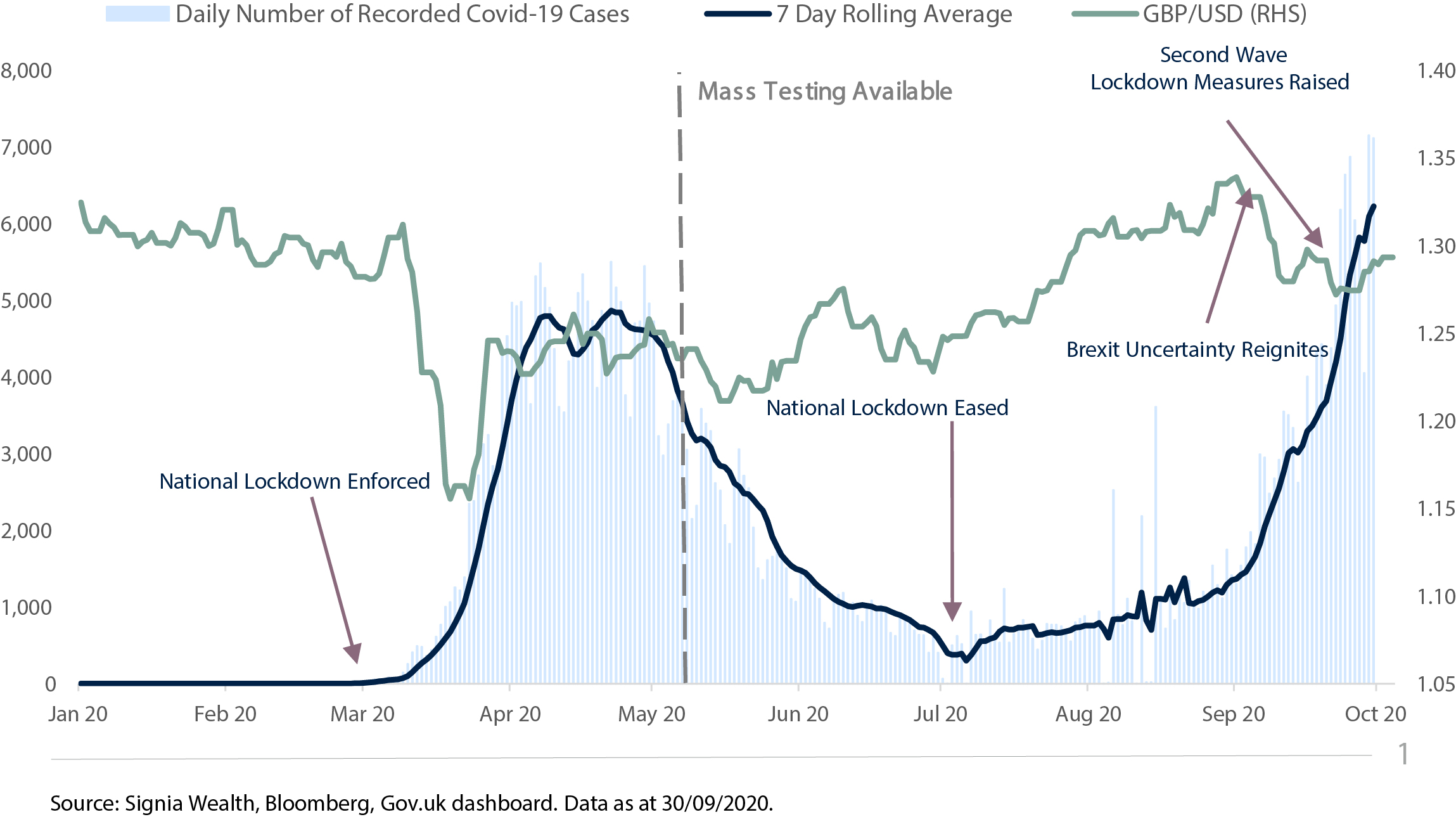

At the end of September there were over 7,000 recorded infections per day in the UK, rising exponentially above that of the first recorded wave of infections seen back in March and April. Admittedly, there was no mass testing during the first wave, which scientists predict could have been as bad as between 60,000 and 100,000 new cases per day at its peak. Nonetheless, the second wave has again caught the British government off guard and is gathering pace without a fully functioning test, track and trace system in place, causing the British pound to start sinking once again under the twin pressures of Coronavirus and Brexit. Winter is coming, and potentially also a hard Brexit.

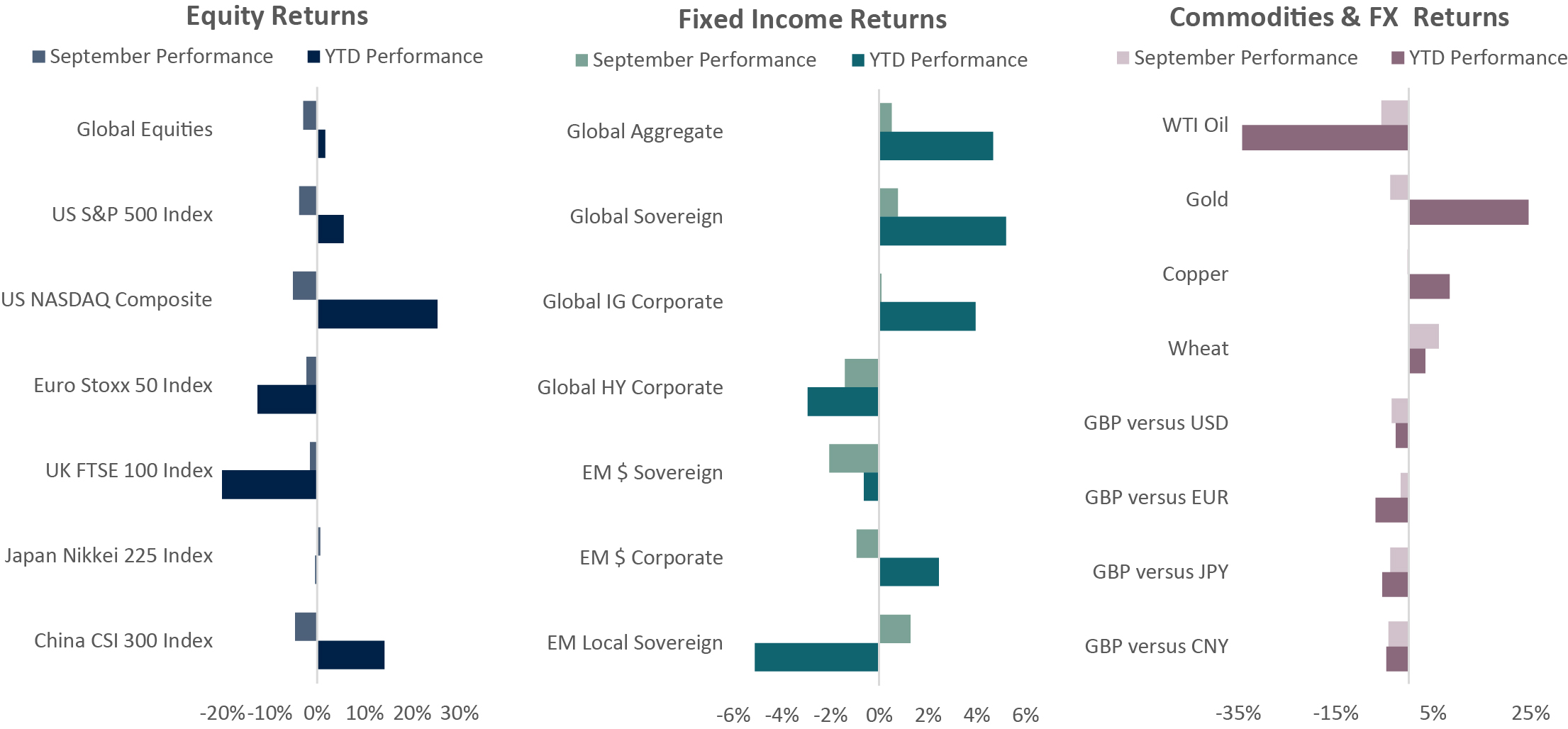

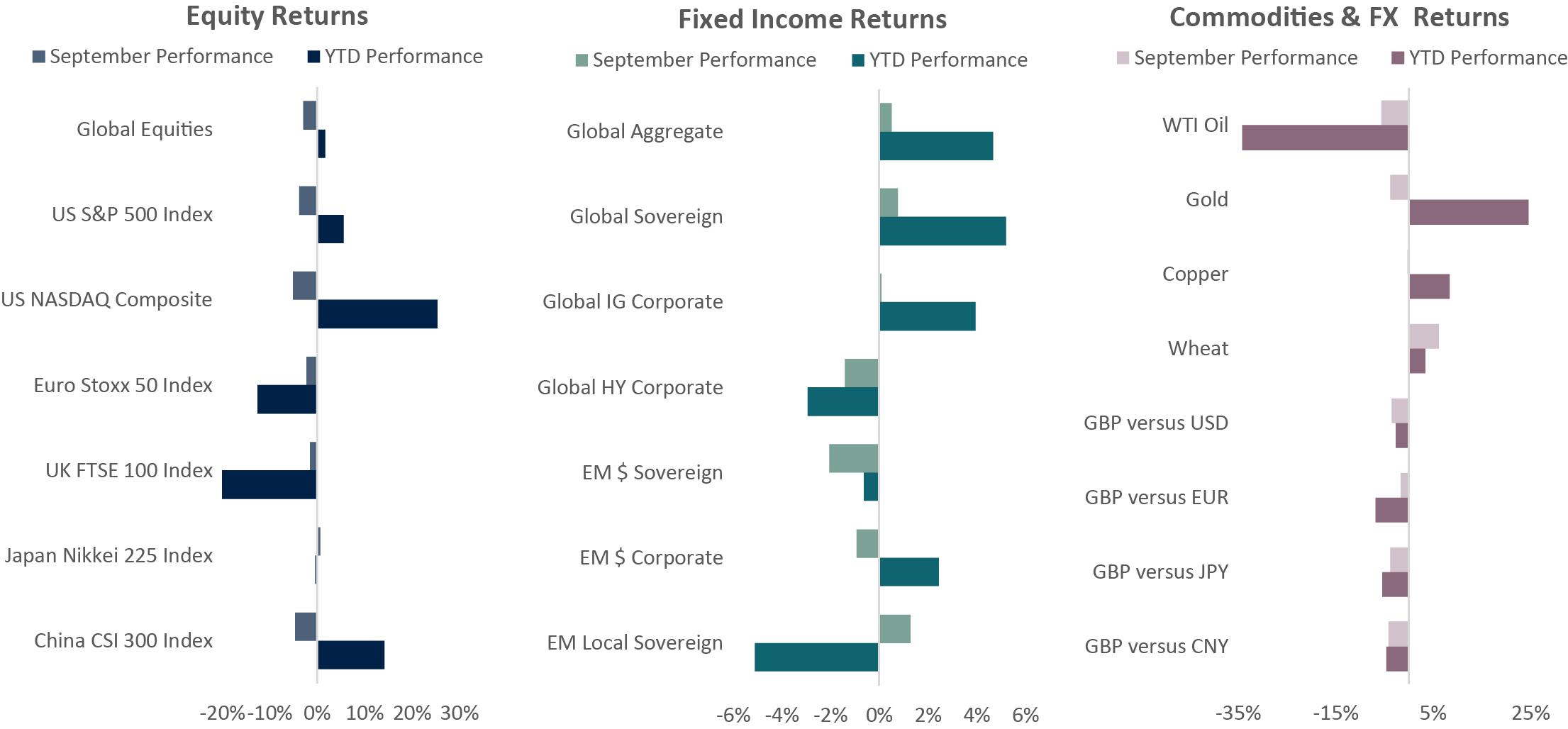

Source: Signia Wealth, Bloomberg. Data as at 30/09/2020. Global Equities: iShares MSCI ACWI ETF; Global Aggregate: Vanguard Global Bond Index GBP Hedged Fund; Global Sovereign: Xtrackers Global Government Bond GBP Hedged ETF; Global IG Corporate: Vanguard Global Corporate Bond Index GBP Hedged Fund; Global HY Corporate: iShares Global High Yield Corporate Bond GBP Hedged ETF; EM$ Sovereign: iShares J.P. Morgan USD EM Bond ETF; EM$ Corporate: iShares J.P. Morgan USD EM Corporate Bond ETF; EM Local Sovereign: iShares J.P. Morgan EM Local Government Bond ETF.

Equities

• US equities underperformed during September, with technology stocks weighing on the index as investors re-assessed valuations.

• European and UK bourses recorded marginal losses, however Japanese equities posted a small gain due to their greater cyclical content.

• Domestic Chinese equities fell, with some consolidation and profit taking being seen after strong performance for the year to date.

Jack Rawcliffe

Fixed Income

• Risk-off sentiment in September saw the global treasuries index gain +0.64% as the US 10 year treasury yield fell from 0.70% at the end of August to 0.68% at the end of September.

• The global investment grade index was almost flat on the month, returning -0.03%, with spreads little moved on the back of continued support from accommodative central bank policy. Global high yield credit however suffered as market volatility peaked to a three-month high, leading the index to fall -1.47%.

• The downturn in markets extended to emerging market debt as all three major indices ended September in negative territory, led by hard currency sovereigns returning -1.88%.

Grégoire Sharma

Commodities & FX

• Sterling slipped against the US Dollar (-3.37%) and Euro (-1.58%) in September, as a result of demand for safety and a reignited no deal Brexit scenario.

• WTI Crude Oil declined over 5.5% as a result of diminishing demand stemming from the virus, and an appreciation in the US Dollar.

• Gold declined over 4% as a result of a rising Dollar and muted inflation expectations. The precious metal is still up nearly 29% for 2020.

Harry Elliman

Choose a Service to Invest through

World

Expectations for world economic growth in 2020 continue to be revised down in the wake of the Coronavirus crisis, from+3.1% at the end of 2019 to -3.9% in September. Asian economies are expected to outperform with China and Taiwan the only major economies expected to grow this year. Currently, world growth is expected to rebound strongly in 2021, although this remains largely contingent on a successful vaccine rollout and the severity of a Covid-19 winter wave.

United States of America

The US economy rebounded quicker than expected over the summer after the shortest sharpest recession in history, which saw the economy contract -10.4% in nominal terms during the first half of 2020. However, coronavirus infections remain high, employment gains are losing momentum, and congress remains divided on further fiscal stimulus measures to help main street where small businesses are struggling.

Eurozone

Europe entered 2020 on a relatively weaker economic footing with a weaker structural growth rate and so it’s no surprise that it has experienced a deeper recession this year versus other regional economies. Deflation risk is a real concern with consumer prices declining -0.2% year-on-year in August, but with the European Recovery Plan now agreed amongst member states, expectations for higher economic growth in 2021 and beyond are rising.

United Kingdom

The UK has followed a similar economic fate to the Eurozone but after being slower to introduce coronavirus containment measures the UK has suffered a worse economic fate with the highest Covid-19 deaths for any country in Europe. An increasingly likely no-deal Brexit at the end of the year has yet to impact the economic outlook for 2021.

Japan

The ruling Liberal Democratic party has elected Yoshihide Suga to soon succeed outgoing Prime Minister, Shinzo Abe, who resigned due to health reasons. Abe leaves a struggling Japanese economy that has been supported by some of the most significant monetary and fiscal stimulus packages announced by any country relative to its size.

China

China is one of very few global economies that has avoided a recession this year by growing an impressive 11.5% in the second quarter after quickly returning economic operating capacity back towards pre-pandemic levels. Chinese GDP is expected to continue its solid growth path and rebound close to its long-term historical growth rate of 8% in 2021.

Emerging Markets

Emerging economies outside of Asia have been amongst the last to feel the full economic and humanitarian impact from the coronavirus crisis. Performance is expected to be mixed this year with commodity producers Brazil and Russia suffering from a collapse in prices, India as a net importer of commodities benefitting from price declines; and Taiwan and South Korea feeling less economic pain due to successful virus containment measures and China trade tailwinds.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.