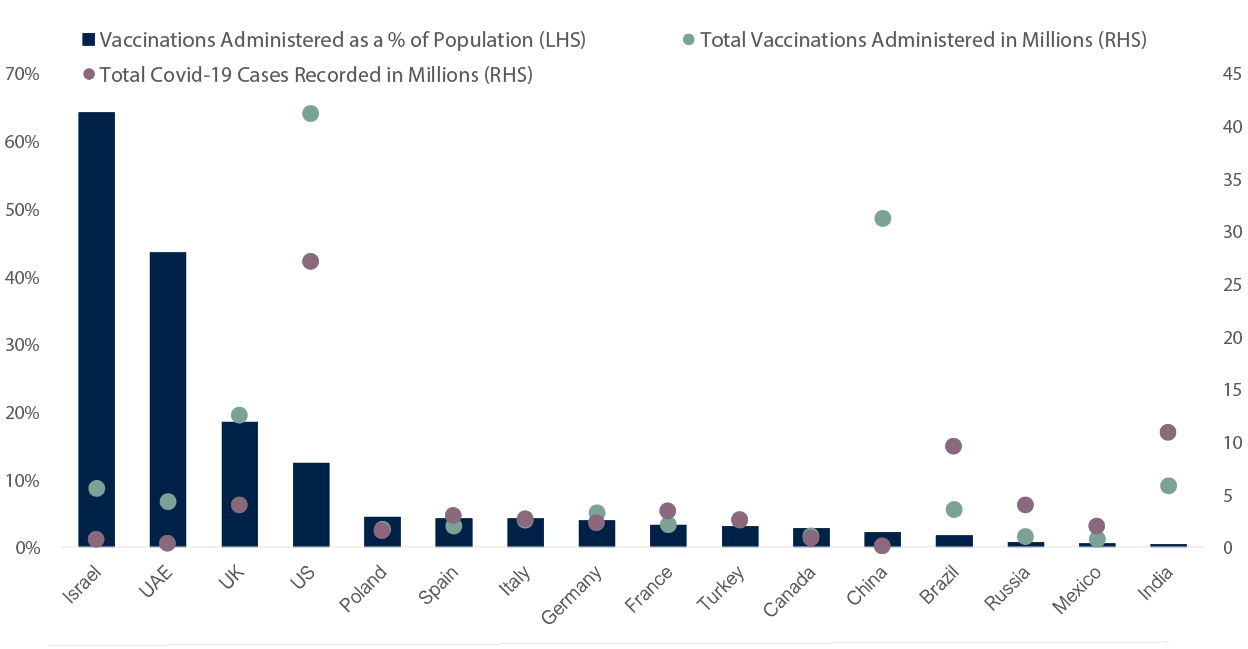

Vying for Vaccinations in the Race Towards Immunity

It was an action packed start to the year in January with a surprise US Senate victory for the Democrats and subsequent shocking storming of Capitol Hill, the price of Bitcoin continued on its exponential December path to double in as little as 3 weeks, and last but not least the little known videogame and electronics retailer, GameStop, become the most famous company in global financial markets for a week as it’s share price rocketed over 1700%after it got caught up in the fight between small Robinhood investors and big institutional hedge funds. All of this to a soundtrack of increasing coronavirus restrictions around the world!

As we approach the anniversary of the pandemic, very few would have predicted infection rates to still be so high, but equally, even fewer would have predicted the medical marvel of human science and intuition in developing a vaccine to fight the virus over such a short period of time. Indeed, the development and approval of multiple vaccines from multiple countries worldwide has truly been a remarkable achievement and has allowed the human race to embark 2021 on a global vaccination programme towards herd immunity.

According to the World Health Organization, there are currently 236 covid-19 vaccines being tested, from early pre-clinical trials to late phase 3 wider efficacy assessments. However, despite several vaccines having already been approved and manufactured, and consequently vaccination programmes worldwide having already started in earnest, the vast majority of these vaccines (171 as of 26th January) are only in early trials and may never progress further.

Thus far, in the race towards herd immunity –defined as the indirect protection from an infectious disease that happens when a population is immune either through vaccination or immunity developed through previous infection – scientists estimate that a threshold somewhere between 60-90% would be the minimum required for covid-19 herd immunity.

Israel has been the fastest out the starting blocks and has already met this lower threshold, having vaccinated 64% of their population as at 8th February. The UAE, UK and US have also started quickly, but with supply, logistical, poverty imbalances, and political nationalism issues disrupting the global rollout programme to other countries (the EU’s ‘prickly as a pineapple approach’ imposed a technical hard border in Ireland for a few hours before withdrawing it in a fight with AstraZeneca over vaccine supplies), overall it has been far from a perfect start. Sadly, most countries will not reach herd immunity until at least 2022.

Vaccinations Administered as a % of Population

Source: Signia Wealth, Bloomberg, Our World in Data, Worldometers. Data as at 08/02/2021

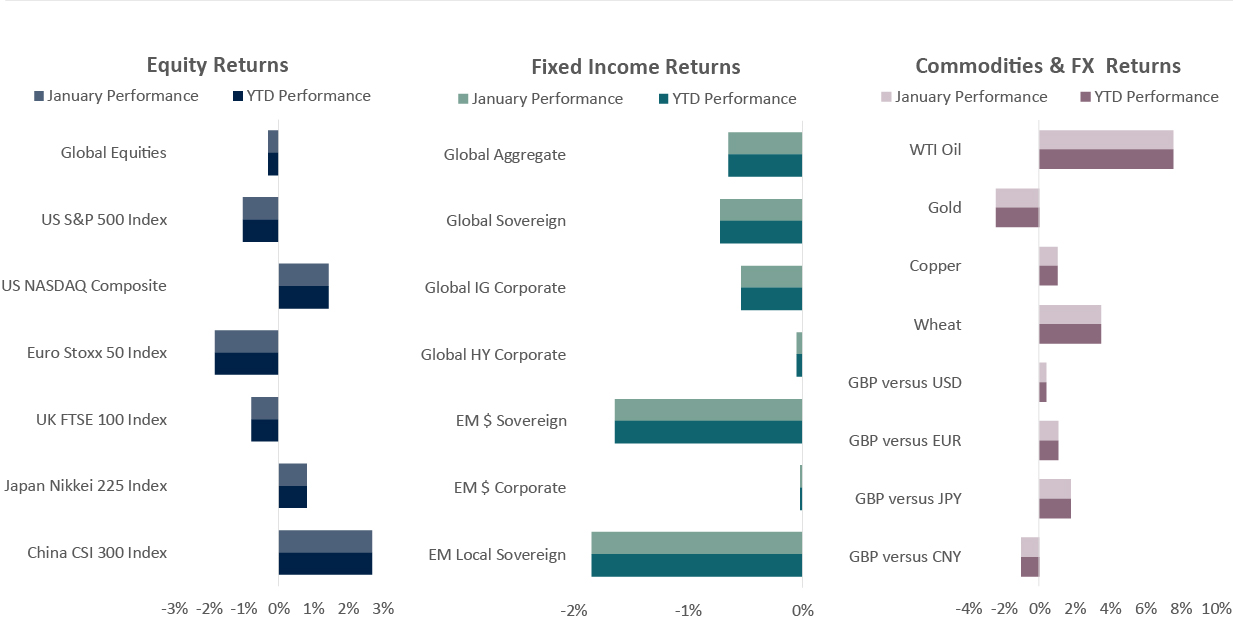

Source: Signia Wealth, Bloomberg. Data as at 31/01/2021. Global Equities: iShares MSCI ACWI ETF; Global Aggregate: Vanguard Global Bond Index GBP Hedged Fund; Global Sovereign: Xtrackers Global Government Bond GBP Hedged ETF; Global IG Corporate: Vanguard Global Corporate Bond Index GBP Hedged Fund; Global HY Corporate: iShares Global High Yield Corporate Bond GBP Hedged ETF; EM$ Sovereign: iShares J.P. Morgan USD EM Bond ETF; EM$ Corporate: iShares J.P. Morgan USD EM Corporate Bond ETF; EM Local Sovereign: iShares J.P. Morgan EM Local Government Bond ETF.

Equities

• Japanese and, in particular, Chinese equities outperformed other indices during January, with both less affected by coronavirus than other economies.

• US equities fell during the month as a worsening coronavirus situation and mixed corporate earnings weighed on sentiment, though technology companies managed to achieve positive returns.

• European and UK equity markets posted negative returns, as renewed coronavirus restrictions and their impact on economic growth dampened risk appetite.

Jack Rawcliffe

Fixed Income

• The global treasury index fell in January as the pickup in activity post the March 2020 Covid crisis led to higher inflation expectations and higher interest rates, hurting longer duration assets.

• Global corporate credit indices were mixed this month with global investment grade credit suffering due to the higher duration nature of the asset class whilst global high yield credit outperformed on a relative basis on the back of significantly shorter duration but also investors’ hunt for yield which continues to provide a strong technical support.

• Emerging market debt also had a mixed month with EM hard currency and local sovereign indices underperforming due to the pickup in US rates and the move up of the dollar in January whilst EM corporate debt was flat.

Grégoire Sharma

Commodities & FX

• Despite the prospect of further fiscal stimulus in the US after the Democrats winning the Senate, Gold shed 2.7% in January on the back of a rising dollar and higher yields, thus increasing the opportunity cost of holding the non-yielding metal.

• Concerns surrounding the Federal Reserve moderating its asset purchase programme, rising yields, and improving US outlook compared to Europe, enabled the Dollar to gain +0.7% for the first time in two months against a basket of peers in January.

Harry Elliman

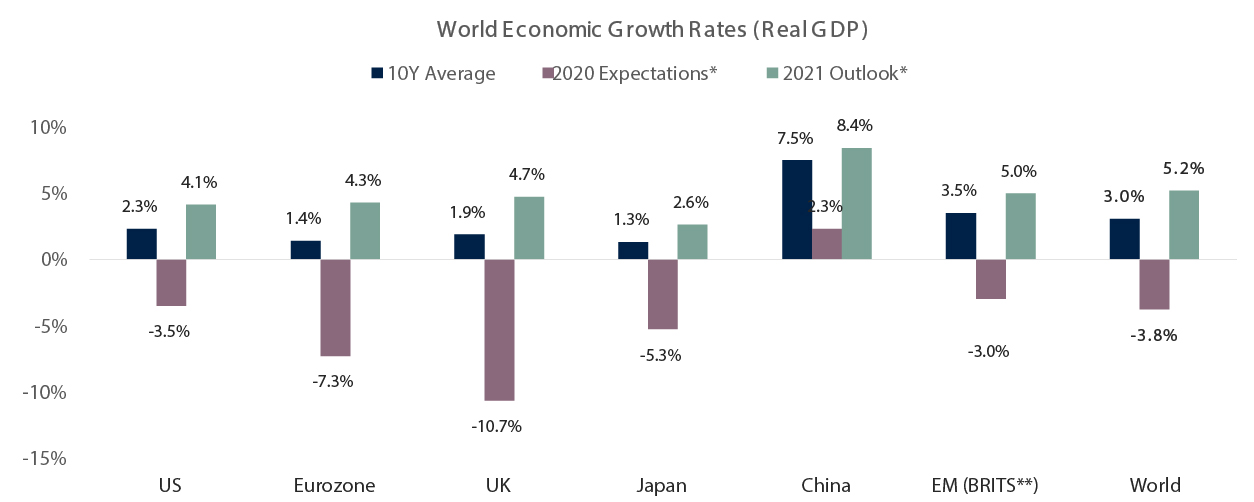

World Economic Growth Rates (Real GDP)

*Bloomberg Contributor Composite expectations. **Brazil, Russia, India, Taiwan, South Korea. Source: Signia Wealth, Bloomberg. Data as at 31/01/2021.

Choose a Service to Invest through

United States of America

The US economy rebounded quicker and stronger than expected last year after the shortest sharpest recession in its history, which saw the economy contract -10.4% in nominal terms during the first half of 2020. However, Coronavirus infections remain high and is top of the list for the new Biden administration to tackle. The Democrats hold control of the White House and Congress and should be able to boost government spending and pass additional fiscal programmes.

Eurozone

Europe experienced one of the deeper economic recessions versus other regional economies and despite a bounce back in price levels in January, will be battling deflation risks across the regional bloc this year. Second economic lockdowns are still largely in force as winter COVID-19 infections persist, further pressuring inflation expectations, However, with funds from the recently approved European Recovery Plan due for distribution to EU member states this year, and continued ECB stimulus support, expectations for higher economic growth in 2021 and beyond are rising.

United Kingdom

The UK suffered a worse economic and humanitarian fate relative to the Eurozone after being slower to introduce Coronavirus containment measures that were amongst the strictest in Europe. December and January have seen stricter lockdowns reminiscent of the initial March 2020 lockdown, but a No Deal Brexit was avoided with a last minute deal agreed on goods, but not on the predominant services industry so there remains plenty of economic uncertainty.

Japan

Japan is experiencing a third coronavirus wave that is significantly worse than its spring and late summer waves, which has seen their Prime Minister declare a state of emergency in parts of the country. No vaccinations programme yet as Japan waits for testing results from trials on its own domestic population. There is massive policy support but a vaccine-sceptic population may slow a return to economic normality in 2021 and beyond.

China

China was one of only two global economies that avoided an economic recession last year and expanded economic output beyond pre-pandemic levels in 2020 (the other country being Taiwan). Chinese GDP is expected to continue its solid growth path and rebound to its long-term historical growth rate of 8% in 2021. China’s new five-year economic plan elevates its self-reliance in technology into a national strategic pillar, most likely as a direct result of growing competitive tensions and trade wars with the US.

Emerging Markets

Emerging economies, mostly outside of Asia, are still feeling the economic and humanitarian impact from the Coronavirus crisis. Economic performance was mixed in 2020 with commodity producers Brazil and Russia suffering from a collapse in prices, India as a net importer of commodities benefitting from price declines but suffering badly from a protracted and damaging first wave on infections; and Taiwan and South Korea feeling less economic pain due to successful virus containment measures and buoyant trade tailwinds with China.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.