Hello old friend, where have you been for three decades?

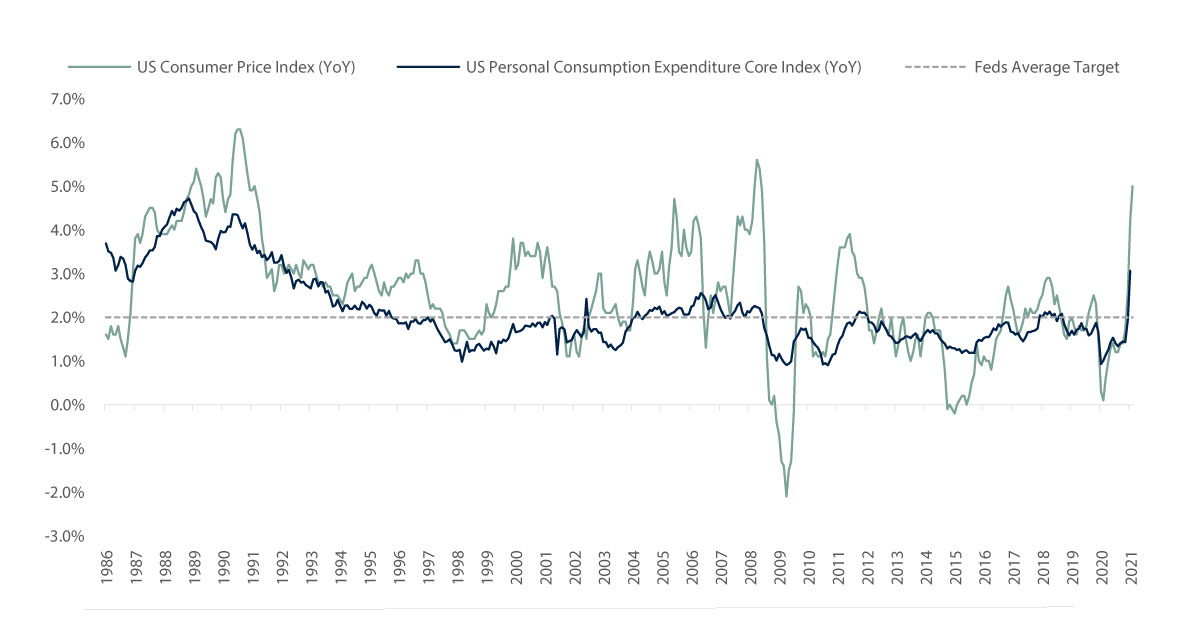

Since the Global Financial Crisis, the resuscitation of inflation has been top of the Christmas wish list for central bankers worldwide, who have struggled to invoke a sustained resurgence in consumer prices (CPI) despite what can only be described as copious amounts of quantitative easing and monetary stimulus. However, the US Federal Reserve’s (Fed’s) preferred inflation indicator – the US Personal Consumption Expenditure (PCE) Core Index – has been broadly languishing below the Fed’s 2% target level since 1996. The PCE Index is based on what businesses are selling and includes some indirect expenditures such as employer-provided medical care insurance, whereas the CPI Index measures what households are directly buying.

The ‘core’ element removes the more volatile short-term price fluctuations from food and energy components and allows the Fed to focus on longer term inflation trends and dynamics. Last year, the Fed changed its 2% fixed target level to an average target level in an attempt to justify unprecedented amounts of pandemic-induced stimulus that could result in inflation running above its target level for an extended period of time. Moreover, it is also an attempt to increase future expectations of inflation, which in turn should support more consumer spending and subsequently higher price levels today in a self-sustaining cycle.

The early signs of inflation awakening from its near three decade slumber are encouraging, as US CPI and US Core PCE year-on-year inflation have risen to 13 and 29 year highs, respectively. However, so far it seems that most of this move has been driven by low base effects from last year’s pandemic, a strong rebound in postponed consumer spending demand from economic lockdowns, and supply backlogs and bottlenecks as factories re-open.

A full house of inflation pressures at a time when G20 governments have re-opened the fiscal taps alongside the monetary taps, which have some economists worried about inflation spiralling out of control. There’s nothing to worry about according to the Fed, who deem these inflationary factors as ‘transitory’ and expect inflation levels to fall back towards 2% next year as 7.6 million workers that still remain unemployed since the start of the pandemic highlight the persistent slack in the US economy. Alas, there is a fly in the Fed’s inflation ointment.

These workers are still receiving generous pandemic-relief unemployment insurance benefits, with many getting paid more to stay at home instead of returning to their jobs. Meanwhile, wage inflation pressures are building as labour shortages permeate across the US economy, and it is wage inflation that has historically driven longer term consumer prices higher.

Source: Signia Wealth, Bloomberg. Data as at 31/05/2021.

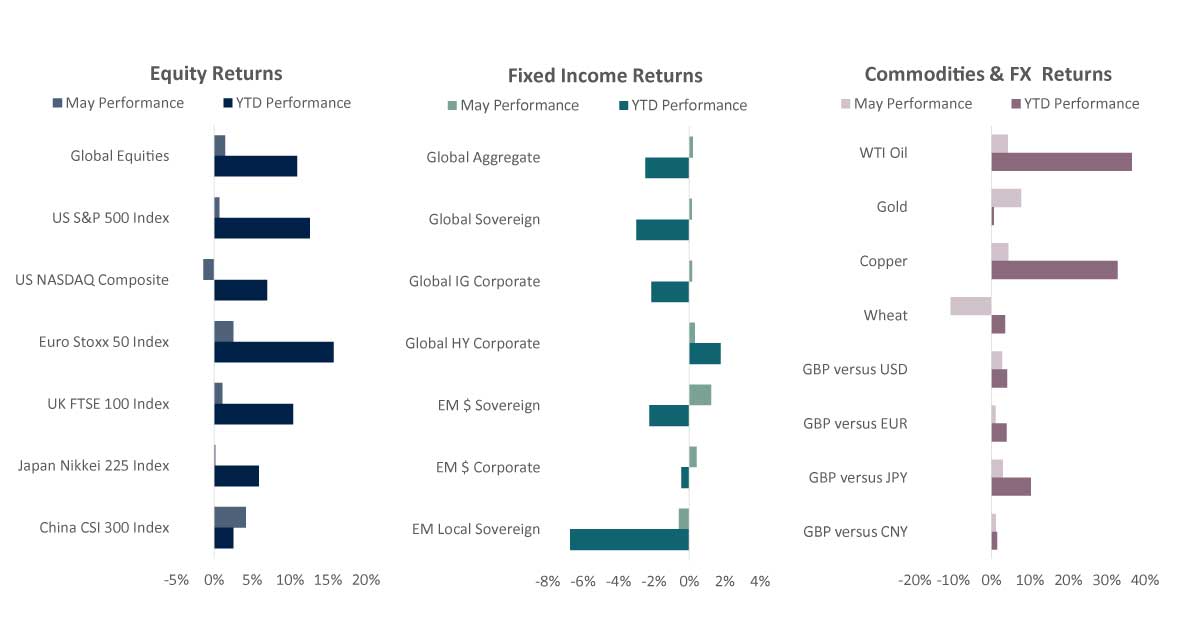

Source: Signia Wealth, Bloomberg. Data as at 31/05/2021. Global Equities: iShares MSCI ACWI ETF; Global Aggregate: Vanguard Global Bond Index GBP Hedged Fund; Global Sovereign: Xtrackers Global Government Bond GBP Hedged ETF; Global IG Corporate: Vanguard Global Corporate Bond Index GBP Hedged Fund; Global HY Corporate: iShares Global High Yield Corporate Bond GBP Hedged ETF; EM$ Sovereign: iShares J.P. Morgan USD EM Bond ETF; EM$ Corporate: iShares J.P. Morgan USD EM Corporate Bond ETF; EM Local Sovereign: iShares J.P. Morgan EM Local Government Bond ETF.

Equities

• Chinese equities achieved the strongest returns during May, with investors buoyed by robust corporate earnings and attractive valuations relative to other markets

• European and UK bourses were next best, as their greater exposure to cyclical companies performed well in light of encouraging economic data and slowing COVID-19 cases

• US markets achieved modest positive returns overall, though higher-growth stocks fell due to sharply higher inflation pushing up bond yields

Jack Rawcliffe

Fixed Income

• The global sovereign index was broadly flat as strong economic data releases coupled with ongoing vaccine rollout increased investors’ concerns that upside data surprises may lead to more persistent inflation and force central banks to start tapering earlier than expected.

• Global credit indices ended the month in positive territory as earnings releases continued to show improving profitability and increasing cashflow across the credit spectrum. Spreads ground tighter supporting investment grade credit with higher oil prices further benefitting high yield credit.

• Emerging market indices were mixed on the month as hard currency indices (sovereigns and corporates) outperformed local currency sovereigns as the latter suffered increased volatility in Latin America on the back of uncertainties over elections and reforms.

Grégoire Sharma

Commodities & FX

• The British Pound rallied against the US Dollar over May as the UK lifted covid-related restrictions amid higher vaccination rates.

• Gold had its second positive month in 2021 supported by stabilising US Treasury yields and evidence of higher than expected inflation during the month.

• Copper and Oil continued their stellar year to date performance with another positive month, fuelled by a weaker US Dollar and growing commodity demand as economies begin to re-open.

Harry Elliman

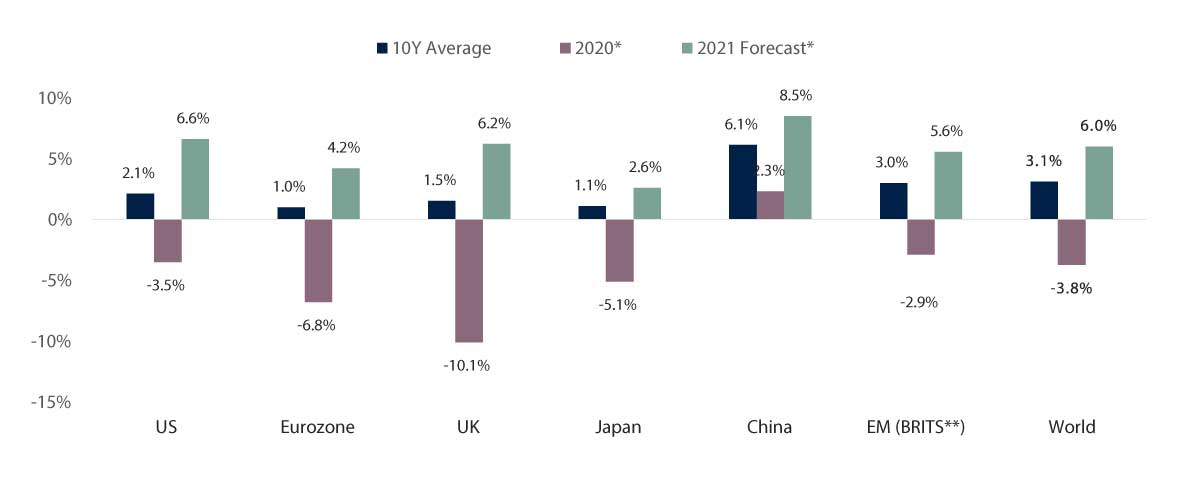

World Economic Growth Rates (Real GDP)

*Bloomberg Contributor Composite Forecasts, except IMF WEO for India. **Brazil, Russia, India, Taiwan, South Korea. Source: Signia Wealth, Bloomberg, IMF. Data as at 31/05/2021

Choose a Service to Invest through

United States of America

The economy is expected to grow in 2021 at its fastest pace since the 1980s as the country’s vaccination programme progresses quickly, pent-up consumer demand from record levels of savings boost consumption, and as fiscal impulse from Biden’s multiple trillion-dollar fiscal packages are deployed. The housing market is showing signs of notable strength and momentum as mortgage rates remain low. The labour market is struggling to fill low paid job openings.

Eurozone

After a slow start European covid-19 vaccinations are picking up and infection rates are declining, leading to the re-opening of the economic bloc this summer. Member countries will soon benefit from the European Recovery Fund, and together with continued ECB stimulus support via the Pandemic Emergency Purchase Programme, expectations for a strong economic rebound in the second half of 2021 and beyond are growing. The German Green Party is now challenging Angela Merkel’s incumbent CDU/CSU coalition in the polls for what could be an historic September election.

United Kingdom

British households have used long winter lockdowns and government furlough schemes to strengthen their finances and become net savers in anticipation of a Spring unlocking and Summer spending spree following a successful vaccine rollout programme to date. The Bank of England raised its estimate for UK GDP growth in 2021 to 7.25% – above market expectations – up from its prior estimate of 5% in February.

Japan

Japan is struggling to control a third and prolonged coronavirus infection wave ahead of hosting the Summer Olympic Games after a very slow Covid-19 vaccination programme. Despite substantial policy support, a vaccine-sceptic population may hamper a significant economic rebound in 2021. Inflation levels are rising, albeit from a negative base and are still significantly lower than across other G10 economies.

China

Chinese economic growth is expected to rebound above its trend growth rate of around 6%, to between 8-9% this year. However, being the first economy to recover from the pandemic last year means that the Chinese recovery is ageing and beginning to slow from its peak, whilst the world economy is accelerating. Its new five-year economic plan elevates its self-reliance in technology into a national strategic pillar, most likely as a direct result of growing competitive tensions and trade wars with the USA.

Emerging Markets

Emerging economies have found themselves lagging the global vaccine rollout programme with most of the poorest EM populations currently largely unvaccinated. Despite the outlook for a more synchronised global growth backdrop in 2021 as broad economic momentum gathers pace and reflation policies take hold, key economies in Brazil, India, Russia and Turkey are still fighting elevated covid-19 infection rates, increasing the risk of the spread of new global virus variants.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.