Signia Invest Insights | 30 September 2023

Market Review and Outlook

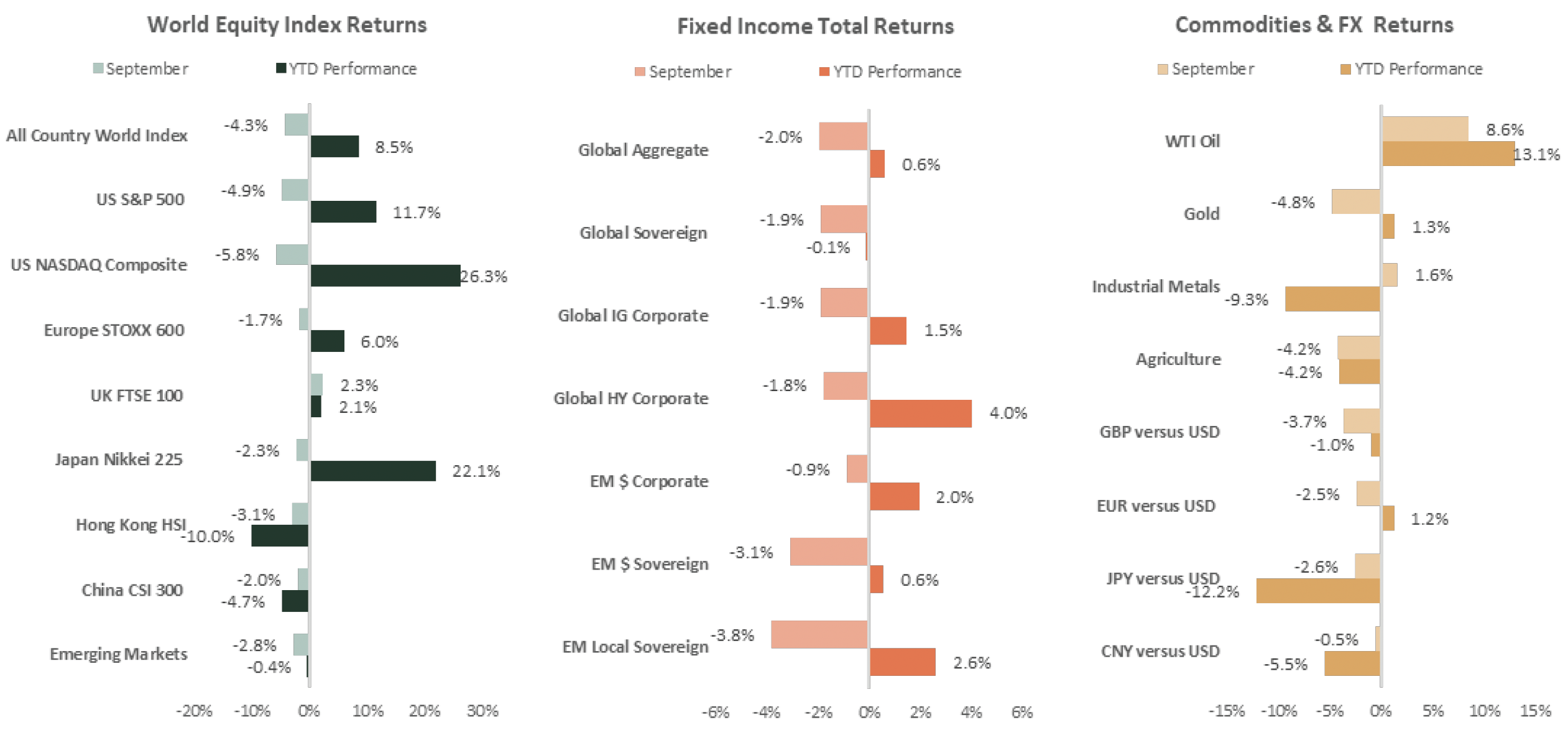

• The macro situation in September deteriorated substantially and, as a result, almost all asset classes lost value during the month with the exception of the FTSE 100 led by energy stocks, Oil, and the US Dollar. The MSCI All Country World Index lost 4.3% in September, whilst European stocks outperformed, losing only 1.7%as a result of support from a weaker Euro, which depreciated 2.5% against the US Dollar. Emerging market equities lost 2.8%, whilst Brazil and India were up for the month due to idiosyncratic factors. With a loss of 4.9%, the S&P500 was one of the worst performers last month, led by underperforming technology stocks as the Nasdaq Composite declined 5.8%.

MARKET PERFORMANCE AS OF 30 SEPTEMBER 2023:

Source: Bloomberg Finance L.P., Arbion Ltd

• Leading indicators have been pointing to weakness since early last year and throughout 2023. Initially, markets corrected accordingly but then rebounded following the regional banking crisis earlier this year as policymakers moved to shore up markets. However, the underlying weakening trends have not subsided and have only gained momentum recently.

• US payroll revisions continue to disappoint on the downside with June putting in a new record with 104k jobs revised downwards from the initial announcement. Other related indicators also point to weakness; the quits rate and labour force participation rate are all consistent with less bargaining power for workers going forward, which is likely to moderate wage growth.

• The US job openings data, which is a good barometer for labour demand in the US economy, continues to normalise from it pandemic-induced peak; a declining trend has historically been accompanied by weakness in the equity markets.

THE REAL AND THE FINANCIAL ECONOMY: S&P500 AND US JOB OPENINGS SINCE 2001:

Source: Bloomberg Finance L.P., Arbion Ltd

• In the US, delinquency rates are rising and banks are tightening lending standards for consumer borrowing at a time when excess pandemic savings are almost exhausted, certainly so for the lower and middle income households.

• Industrial activity appears to be slowing down which can be seen in declining manufacturing PMI surveys while earnings revisions for the sector are also negative.

• Finally, the sizeable boost from Biden’s fiscal spending packages will top out over the next few months, removing another source of impulse to the economy.

• Taken together with rising yields, a strong dollar, and a potential oil price shock, the macro risks are currently clearly tilted to the downside as we enter the fourth quarter.

THREE KEY DRIVERS OF TIGHTENING FINANCIAL CONDITIONS OVER THE SUMMER – ALL HAVE MOVED TO ELEVATED LEVELS:

Source: Bloomberg Finance L.P., Arbion Ltd

• As long-bond yields have pushed higher relative to the short-end, a process called bear-steepening, we have also witnessed yield curve inversions become less pronounced, with the US 3-month minus US 10-year Treasury bond yields reducing by half, from approximately 185 basis points inverted to less than 90 basis points at the end of September.

• In summary, macro-economic trends as well as low frequency/high impact indicators such as the yield curve point towards a further slowing of the economy over the next few months and quarters. Whether it will turn out to be a soft or hard landing is of secondary importance for as long as precautions are in place to hedge the potential negative outcomes of it occurring.

• Looking ahead towards the end of the year, we believe that the current earnings season will provide some important clues about the risk of a deeper economic slowdown and its effect on earnings. The dollar and oil price tightening effects might be somewhat more temporary which leaves rising long-term yields as probably the most challenging factor to watch. In our view, the long end of the yield curve has potential to tighten further, reflecting rising term premia driven by inflation floor levels that appear to be higher in the future than in the past. At the same time, at some stage, we expect central banks to become more vocal about the path to rate cuts in the future, but deep cuts that markets have become accustomed to in previous rate cycles may prove elusive in this one if higher levels of structural inflation are indeed perceived to be transpiring. Both of these trends will un-invert, and thus normalise, the yield curve.

• Technically, markets are somewhat oversold at the moment. Similarly, sentiment is bearish but short of being at extreme levels. Therefore, a meaningful amount of short-term potential downside has been realised over the last weeks whilst we are heading into a seasonally stronger period for equity returns, which could provide some support to a weakening equity market.

• Discrepancies in equity valuations have been increasing between inexpensive and overvalued stocks and on a regional as well as sectorial level, there are many potential investment candidates that appear to offer value. Overall, we believe markets are not universally expensive, neither are they at risk of a major meltdown. Looking at bottom-up fundamentals, we don’t find it very difficult to identify attractively priced long-term investment targets with strong balance sheets and competitive positioning, trading at a valuation that is substantially lower than it was only a year ago.

• Similarly, in the world of fixed income, we find nearly generational buying opportunities in many issuers that are fundamentally sound and where yields are now substantial – something not seen since the end of the 2008 financial crisis.

• As a result, there is no shortage of investment ideas and great potential on the horizon to diversify capital out of cash and cash equivalents, and into fixed income and equity markets. Yes, prepare to wrap up warm because winter is coming (if you’re in the northern hemisphere), but you may want to forego the hibernation this year as the opportunity to pick up some names at near bargain prices may well present itself, perhaps even ahead of Christmas, should the chill in markets continue into year end!

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia Invest. Information about prior performance, while a useful tool in evaluating Signia Invest’s investment activities is not indicative of future results and there can be no assurance that Signia Invest will generate results comparable to those previously achieved.

Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia Invest and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns.

The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose.

No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful.

Signia Invest is a trading name of Arbion Limited. This document has been approved and issued by Arbion Limited, Authorised and regulated by the Financial Conduct Authority FCA Registration No 513138. Registered in England and Wales No 7044573. Registered office One Connaught Place, London, W2 2ET.