Going Viral

There have been on average three influenza pandemics in each century over the last 300 years, defined as a flu virus that spreads on a worldwide scale infecting a large proportion of the population. The most severe in the last century was the 1918 Spanish flu pandemic resulting in 500 million infections with a fatality rate of 2-3%, whilst the most recent was in this century with the 2009 H1N1 virus or ‘swine flu’ pandemic resulting in up to 200 million inflections but a far lower fatality rate of under 0.1%.

The recent novel coronavirus outbreak in the Chinese city of Wuhan has not reached pandemic levels yet, but with the virus having now spread internationally with tens of thousands of reported cases and a fatality rate between 2-3% – similar to the Spanish flu – it’s looking increasingly likely that we’ll soon be recording a second global influenza pandemic only twenty years in to this century.

Whilst clearly a cause for concern to both investors and the general world population, it’s important to note that seasonal flu infects up to 1 billion people every year and so is extremely common but carries a significantly lower fatality rate of less than 0.1%. However, the novel coronavirus carries a fatality rate approximately 30 times deadlier than this and so the risk of contagion and threat of another pandemic should be taken seriously.

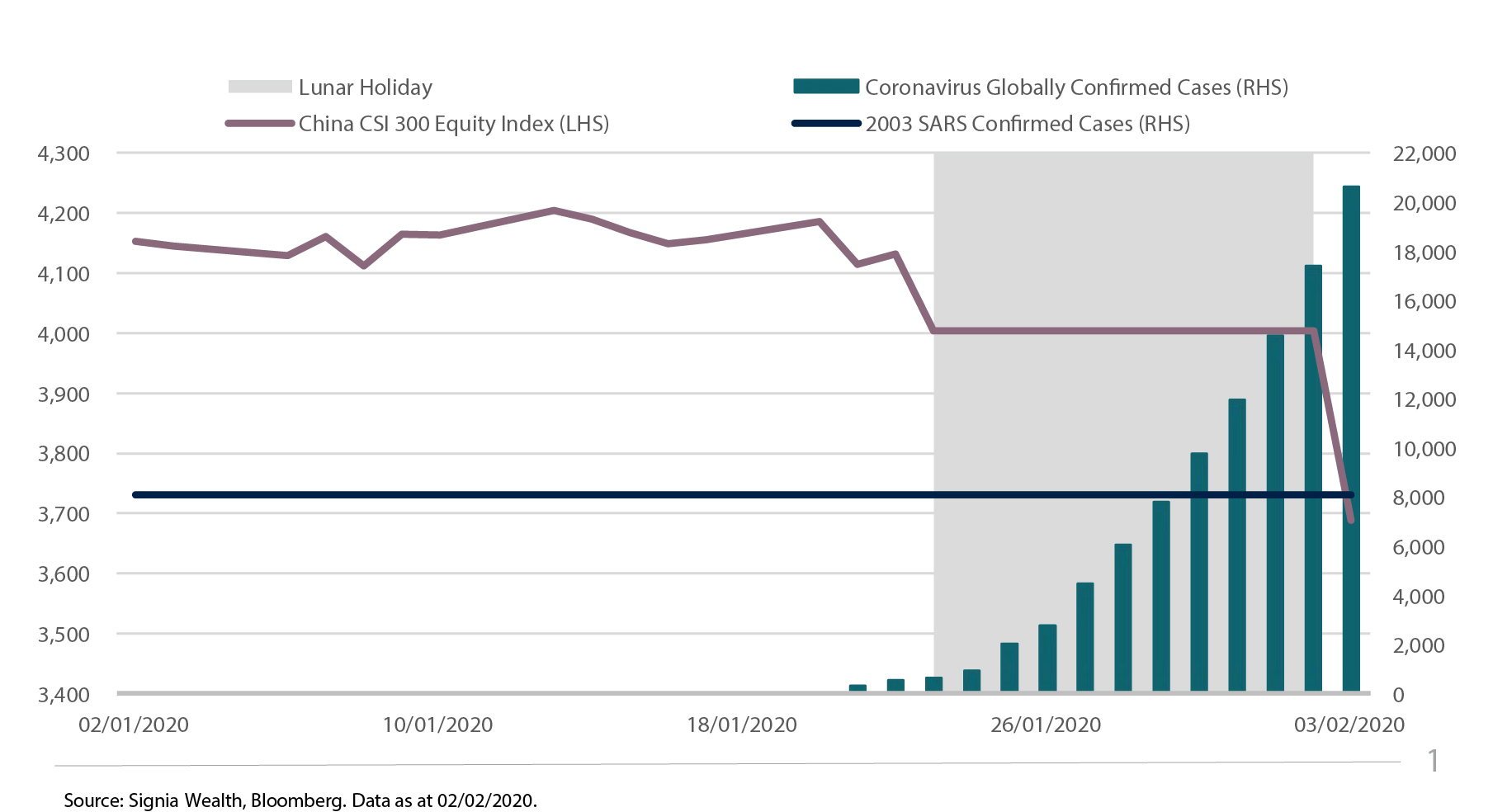

The first reported case was discovered only recently in late December 2019 but initially its seriousness and threat was underestimated by authorities. During the subsequent 10-day Chinese New Year Lunar holiday, reported cases had risen exponentially from a few hundred to over twenty thousand. Unsurprisingly, when Chinese stock markets re-opened for business on February 3rd they suffered heavy declines as panic selling set in, causing the CSI 300 domestic equity index to decline by -8%.

Whilst potentially a short-term market overaction, it’s clear that the impact of the coronavirus on the Chinese economy – the second largest in the world – will be severe, with critical interruptions to consumer demand and business supply chains, manufacturing and services sectors, and both internal and external economic trade networks.

Despite the Chinese central bank having declared its support for the economy with liquidity injections and easier monetary conditions, it’s still too early to predict a V-shaped recovery this year, at least until the spread of the virus and its human threat have peaked. An economic contraction in Q1 is almost a foregone conclusion, but with a high degree of uncertainty still in play, a U-shaped or even L-shaped recovery remains an inconvenient but real possibility.

Chinese Stocks Decline as the Coronavirus Spreads

Source: Bloomberg, Signia Wealth. Data as at 31/01/2020. Equities: Equity indices reflect MSCI net total returns in local currency, except Asia and EM in USD. Fixed Income: Global Agg: Bloomberg Global Aggregate TR Hedged GBP; Global Sovereign: Bloomberg Global Treasury TR Hedged GBP; Global IL: Bloomberg World Govt Inflation Linked Bonds 1-10Y TR Hedged GBP; Global IG: Bloomberg Global Corporate TR Hedged GBP; Global HY: Bloomberg Global High Yield TR Hedged GBP; EM$ Sov: Bloomberg Emerging Markets Sovereigns TR Hedged GBP; EM$ Corp: Bloomberg EM USD Corporate 10% Cap Hedged GBP; EM Local Sov: Bloomberg EM Local Currency Govt TR Unhedged USD; Commodities: Bloomberg Commodity TR Index; Global Property REITS: FTSE EPRA/NAREIT Global Index; Global Hedge Fund: HFRX Global Hedge Fund Index; British Pound: Bloomberg British Pound Index; Euro: Bloomberg Euro Index; US Dollar: Bloomberg US Dollar Index; EM Currency: JP Morgan Emerging Market Currency Index.

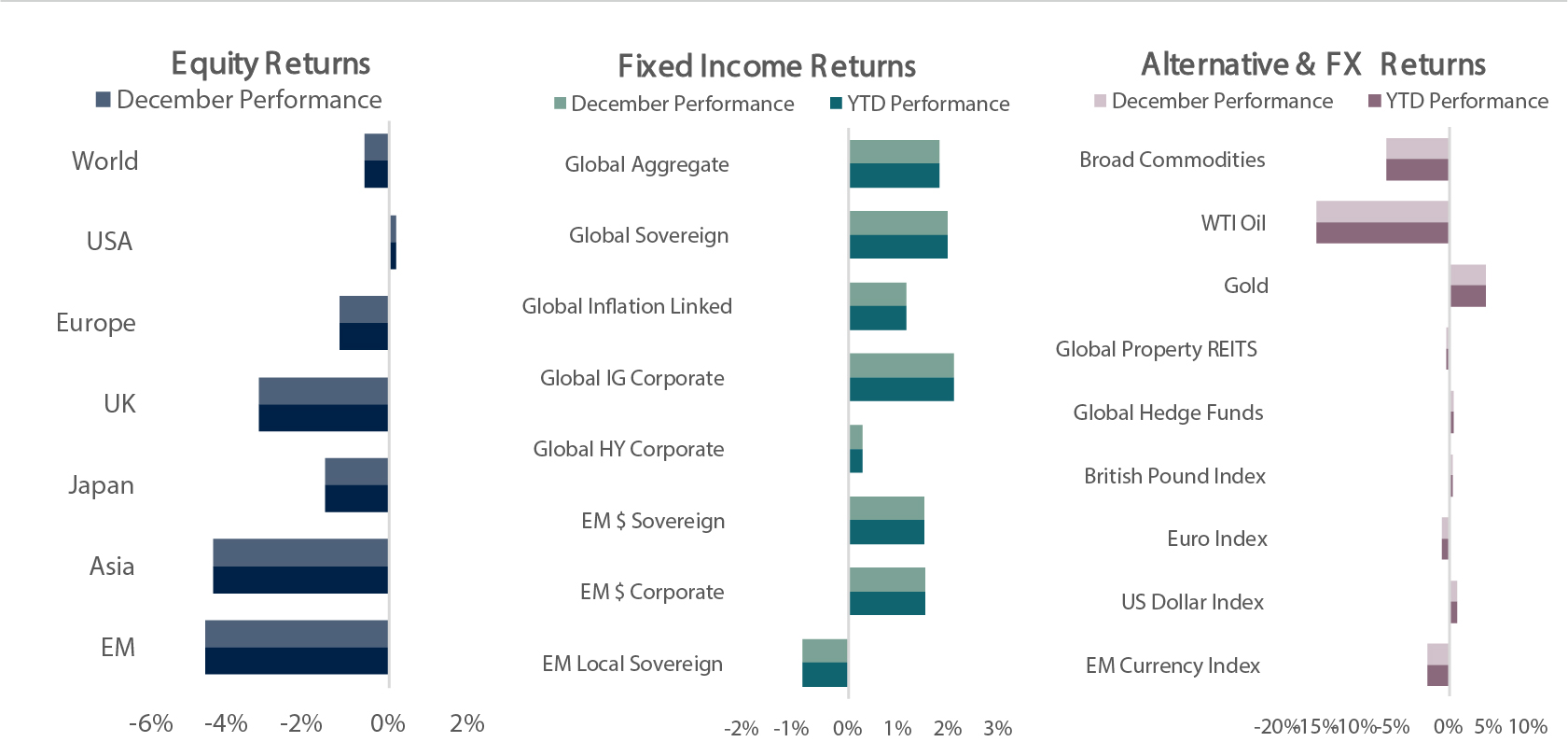

Equities

• US equities outperformed in January as strong corporate earnings outweighed Coronavirus concerns

• European and Japanese equity bourses were next best, recording small losses as the economic impact of the Coronavirus dominated sentiment

• UK equities underperformed their developed market counterparts as ongoing Brexit worries occupied investors • Emerging market and Asian equity indices were down heavily over the month, as a possible China and global economic slowdown concerned market participants

Jack Rawcliffe

Fixed Income

• The global sovereign debt index was up 1.9 % in sterling hedged terms as a result of the Coronavirus fear sending investors towards safe-haven assets

• Corporate credit indices ended the month in positive territory as the New Year’s new issuance surge started to fade and led to spread compression. Investment Grade credit returned 2.0% as the search for yield continues to drive the asset class whilst High Yield credit generated 0.4% with energy issuers suffering due to the fall in oil prices

Grégoire Sharma

Alternatives & FX

• Despite Oils strong start to the year as a result of elevated tensions between the US and Iran, WTI fell 16% in January in response to the recent outbreak of the coronavirus which has flooded the markets with anxiety over its potential to dampen Chinese and global economic growth

• Gold benefited from investor anxiety in January, appreciating 4.8%. Copper, an indication for global economic growth, declined by more than 10%, reflecting investors’ concerns

Harry Elliman

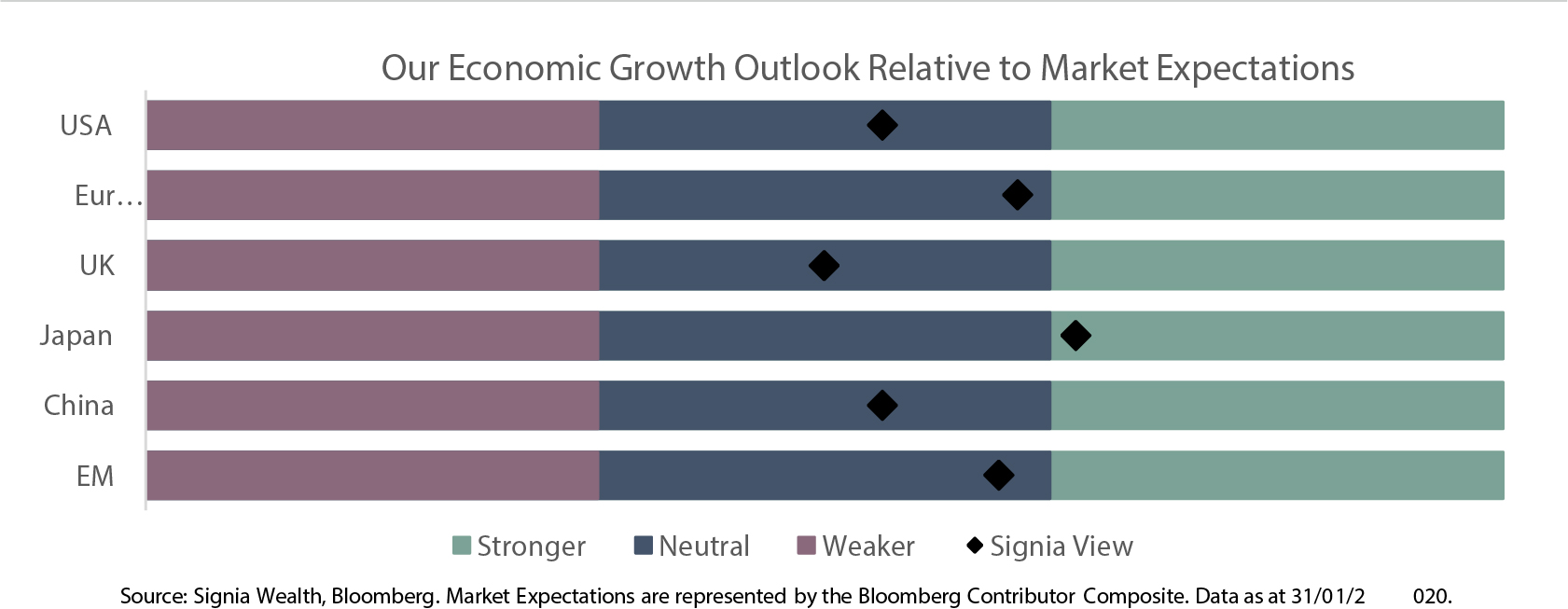

Our Economic Growth Outlook Relative to Market Expectations

Choose a Service to Invest through

United States of America

The Federal Reserve has cut interest rates three times since the summer to combat declining trade war related growth indicators and a potentially stalling economy in Q4 and Q1. Domestic consumers and household balance sheets are in a healthy state, but strong labour market momentum is slowing. In the corporate sector, profit margins have peaked and leverage is rising. 2020 recession risk remains low but political risk will likely be a major economic headwind.

Europe

Growth and inflation indicators remain weakened below long-term trends, led by German and Italian near-recessions, whilst heightened economic uncertainty has caused a decline in real investment and business expectations. The ECB remains committed to a supportive policy stance and expanding its balance sheet, however, any economic recovery this year will likely be contingent on a rebound in global trade and manufacturing.

United Kingdom

Brexit has happened and negotiations are underway to reach a trade agreement with the EU before the ‘transition period’ deadline on 31 December 2020, with monetary policy tied to an outcome as well as recently slowing inflation indicators. Uncertainty will likely persist this year as economic growth remains in a delicate state despite a relatively upbeat labour market. Profit growth and business confidence remain depressed and are weighing on the value of the British Pound.

Japan

Despite a consumption tax hike in October the impact on the economy has been seemingly muted with a recent rebound in business sentiment surveys. With very low market expectations for Japanese economic growth in 2020, the bar has been set very low for an economic recovery, which like Europe, will likely be contingent on a rebound in global trade and manufacturing. The BoJ remains committed to supporting financial conditions.

China

The government and policymakers have reaffirmed their support to stimulate the economy whilst containing the growing outbreak of the coronavirus, with casualties now surpassing the 2003 SARS epidemic. Following a phase one trade deal the tariff drag on the economy from the trade war with the USA has started to dissipate after causing 2019 economic growth to decelerate towards the lower end of the policymaker’s target range of 6.0-6.5%.

Emerging Markets

EM central banks have joined the Fed this year in easing financial conditions and providing needed support for emerging market asset prices following a slowdown in world growth and stronger US Dollar in 2019. Some EM policy rates have reached record lows (South Korea / Brazil). A recent trade war truce between the US and China, and an expected weaker US Dollar in 2020, would be supportive for EM markets.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.